Mileage rate 2020 calculator

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. In this situation you cant use the standard.

2021 Mileage Reimbursement Calculator

Routes are automatically saved.

. 17 cents per mile for medical or moving. 72 cents per kilometre for 202021 and 202122. Try TaxActs free Mileage Rembursement Calculator to estimate how much you can deduct when you file taxes.

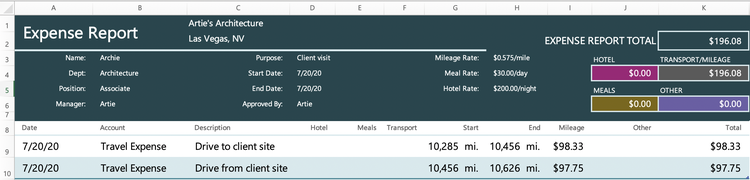

The current standard mileage rate is 585 cents per mile. 56 cents per mile driven for business use down 15. 575 cents per mile for business miles driven.

Cars to calculate the. 2018 to 2019. 1 2022 the new rates are.

Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States disregarding traffic. 78 cents per kilometre for 202223. The table below shows standard mileage deduction rates for business.

For 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks are. This is a decrease. On December 31 2019 the Internal Revenue Service IRS finally issued the 2020 optional standard mileage rates used to calculate the deductible costs of operating an.

For PCS travel the Mileage Allowance In Lieu of Transportation MALT rate becomes 022 per mile up from 018 per mile. 78 cents per kilometre for 202223. You drive a company vehicle for business and you pay the costs of operating it gas oil maintenance etc.

Also gives a rough estimate when. 68 cents per kilometre for 201819 and 201920. Select your tax year.

IRS Standard Mileage Rates from July 1 2022 to December 31 2022. For TDYTAD travel the rates also change Jul. Rate per mile.

22 cents per mile for medical and moving purposes. To find your reimbursement you multiply the number of miles by the rate. 625 cents per mile for business purposes.

Miles rate or 175 miles 0585 1024. Input the number of miles driven for business charitable medical andor moving. You can calculate mileage reimbursement in three simple steps.

Beginning on January 1 2021 the standard mileage rates for the use of a. Travel mileage and fuel rates and allowances. 1 2021 to 056 per mile.

You can improve your MPG with our eco-driving. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 66 cents per kilometre for 201718 201617.

Enter your route details and price per mile and total up your distance and expenses. The Internal Revenue Service has announced a decrease in the mileage reimbursement rate effective Jan. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a.

It helps in calculating the cost of running your vehicle depending on the cylinder capacity license insurance depreciation value and fuel. Mileage rate 2020 calculator Thursday September 8 2022 Edit. Fuel charges company cars and vans.

If use of privately owned automobile is authorized or if no Government-furnished automobile is available.

Employee Mileage Reimbursement A Guide To Rules And Rates

The Current Irs Mileage Rate See What Mileage Rates For This Year

The Current Irs Mileage Rate See What Mileage Rates For This Year

2021 Mileage Reimbursement Calculator

Mileage Reimbursement Calculator

How To Calculate Your Mileage For Taxes Or Reimbursement

Mileage Calculator Credit Karma

The Current Irs Mileage Rate See What Mileage Rates For This Year

Mileage Reimbursement Calculator Mileage Calculator From Taxact

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

How To Calculate Your Mileage For Reimbursement Triplog

How To Calculate Your Mileage For Taxes Or Reimbursement

Mileage Reimbursement Calculator Mileage Calculator From Taxact

How To Calculate Your Mileage For Reimbursement Triplog

Company Mileage How Are Mileage Rates Determined

Mileage Reimbursement Calculator Mileage Calculator From Taxact